Navigating the Demo Software Surge

April 22, 2025

Table of Contents

Interactive demo software emerged only a few years ago but has seen enormous growth. The main driver? As opposed to other early-stage technology, interactive demo software already offers “high benefit” to customers according to Gartner, and mainstream adoption is imminent.1

SaaS go-to-market (GTM) leaders: What can you do to make sure you’re getting “high benefit” from an investment in demo software, and what important trends should you be aware of as you build out a demo program?

At Reprise, we’ve been part of this movement since the beginning. We’ve seen and learned a lot as we’ve helped enterprises weave product experiences into every stage of the GTM motion, and this experience has given us a unique perspective. In this article you’ll learn about the maturation of the category, the key trends that underscore its growth, and benefits realized by organizations that have adopted interactive demo software.

How it started: The need for interactive product experiences

There’s been a shift towards buyer empowerment and increased demand for self-service product experiences. Buyers expect to be able to self-educate and evaluate options before engaging with any vendors. That’s what first established the need for interactive demo software. These trends were heavily influenced by the momentum of product-led growth (PLG) strategies, in which SaaS providers rely on hands-on product access as their primary vehicle for growth.

But the PLG model hasn’t delivered on its promise. Not fully, at least. Specifically, PLG hasn’t shortened sales cycles. According to the 2024 Gartner Market Guide for Interactive Demonstration Applications, “sales cycles are lengthening, now averaging over 17 months among teams purchasing software for their business functions”2 – a clear indicator of how complex enterprise software purchasing has become.

Plus, it’s not practical for many software vendors to offer freemium, self-service versions of their product. This is especially true for complex products, companies selling to regulated industries, and those dealing with highly sensitive data. Across the board, those who do offer a self-service model put the onus on customers to load their own data and find their own way with the product, which many times has a negative impact on their experience. Because of this, many free trials and freemium experiences see lower-than-expected conversions.

Instead, many SaaS companies are adopting “hybrid PLG” strategies – with interactive demo experiences at their core – to reduce friction in the sales cycle. According to Gartner, “Product-led sales or hybrid PLG has the goal of adopting PLG approaches to shorten and fatten sales funnels, with more qualified leads filtering out those that don’t meet usage thresholds or ideal customer profile (ICP) traits.”3

Interactive demo software offers the best of both worlds in this hybrid PLG model – hands-on product access, without relinquishing control over the experience or message.

How it’s going: A maturing market

Interactive demo software is predicted to hit mainstream adoption in the next 2-5 years. And it’s no longer just about product tours built by marketing teams. Use cases for streamlining the creation and delivery of product experiences vis-a-vis live demos and sales leave-behinds have been driving significant growth, expansion and maturation in the category. Likewise, sales and presales personas are fast becoming top users of interactive demo software – but this adds pressure for vendors in the space to offer different capabilities. For instance, the ability to inject synthetic datasets into demos, clone application environments, etc. are top requirements from sales and presales users.

What started as product tour- and video-based demo solutions has evolved significantly to address the expanding market use cases and capabilities needed. Many solutions are still concentrated on the product tour and video side of the market, but new entrants on the interactive demo software scene offer screenshot demos, HTML demos, live app overlays, application cloning, and demo data injection capabilities, just to name a few. And many organizations with strategic demo programs tout that they get the most value running live demos and alternatives to POCs using demo software.

Reprise customers often cite the live sales demo use case as the most critical to their business. In other words, product tours are becoming a nice-to-have, while software for live demos is a must-have. The market is maturing to reflect this shift, with more product tour providers attempting to solve for every use case.

Ultimately, the most valuable demo software is proving to be technology that can handle the full breadth of demo use cases, from website tours and leave-behinds to live demos, customer training and more.

The sum of a demo program is greater than its parts

As Gartner’s research points out, demo programs often start with a single use case but spread virally once the initial use case proves value. The power of demo programs lies in their versatility to offer hands-on product experiences, consistently and at scale.

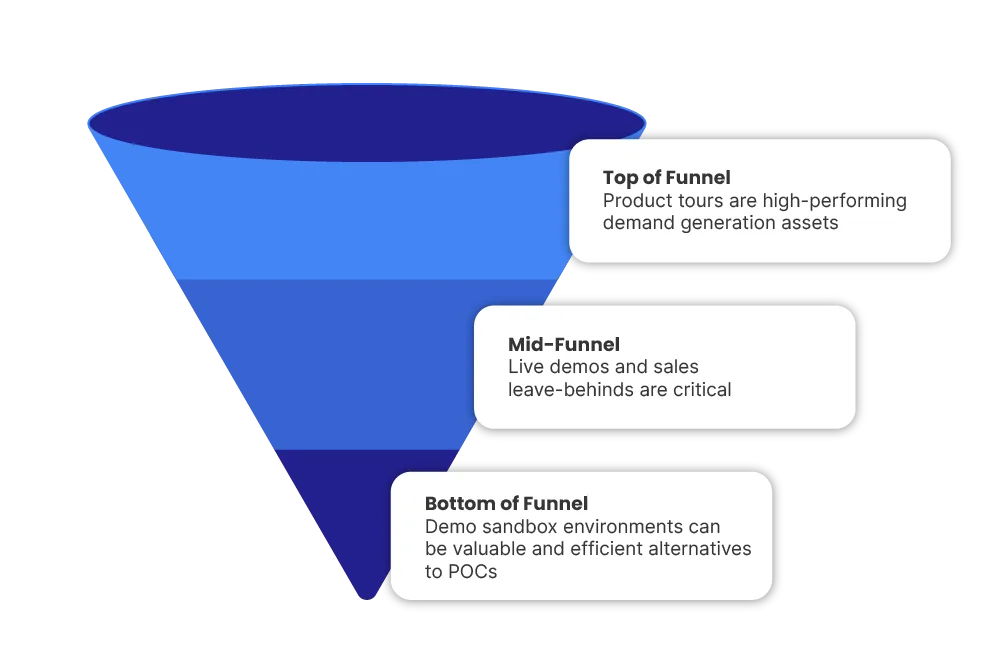

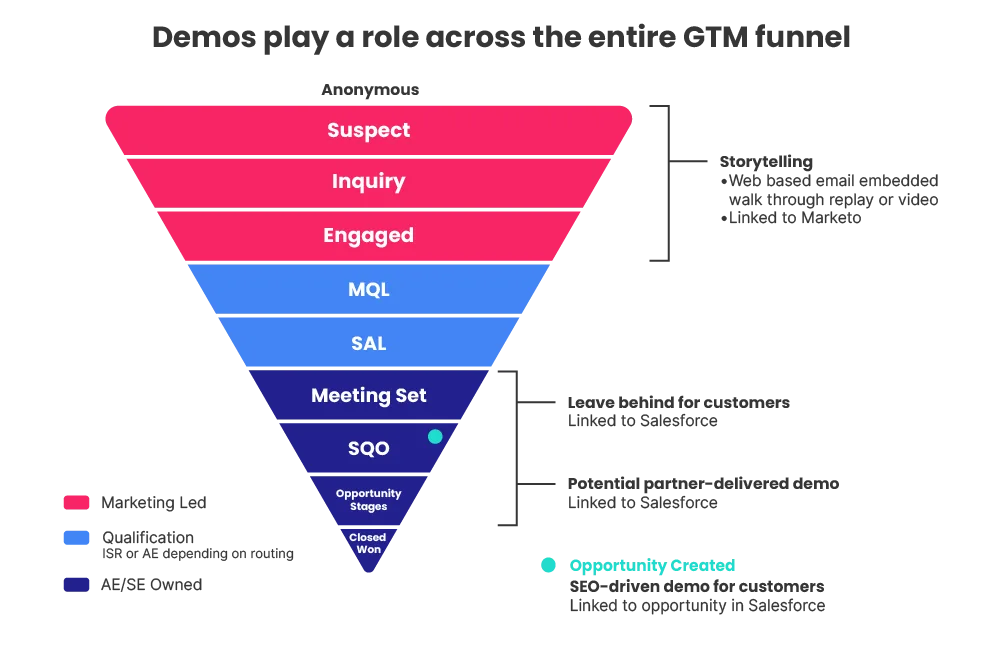

Various use cases for demos help SaaS companies weave tangible product evidence into their story throughout the buyer journey. From interactive product tours driving top-of-funnel engagement, to live demos and sales leave-behinds that accelerate mid-funnel opportunities, to demo sandbox environments that replace proofs of concept (POCs) at the bottom of funnel — the sum of these components creates a powerful, unified, product-led buying experience.

Source: Phil Lowrey, Technical Product Marketing Manager, Cloudera

It’s not just about using demos in different ways and at different times. It’s about bringing sales and marketing claims to life with a consistent narrative that is based on a tangible product. And doing so with a fraction of the resources required to create demos and videos the old-fashioned way.

The effects are palpable

Many GTM leaders that have implemented demo programs agree they’ve revolutionized the way their presales, sales, and marketing organizations work. The impacts are real:

- Shorter sales cycles – By putting product in prospects’ hands earlier, qualification happens faster. Less time is spent explaining the value prop because prospects can see it for themselves. Sales leave-behinds reduce buying friction, making it fast and easy to share demos with a broad buying committee without the headache of scheduling multiple live demos. And a demo environment can often circumvent the need for intensive, time- and resource-consuming POCs. One Reprise client, Hireology, shared that sales cycles using demos built on Reprise closed 50% faster.

- Efficiency gains – Demo software empowers sales to deliver demos independently, allows presales to spend their time on opportunities that really need a human touch, and makes it easy for marketing to build and update product tours that serve as a high-value asset. Demo innovators like Pendo say that their product tours have become the highest-performing call to action on their website.

- Deeper customer insights – One of the most compelling aspects of modern demo programs is their ability to deliver actionable data. By embedding analytics into demo experiences, sales and marketing teams gain insights into buyer preferences, intent, and feature needs. This data enables more targeted and insightful engagements, which are critical to guiding enterprise buyers through long and complex purchasing journeys. Demo analytics can also identify individuals in the buying committee that may need more personalized or targeted follow-up.

Gartner’s Market Guide for Interactive Demonstration Applications emphasizes that “interactive demonstration applications help simplify, accelerate and scale demo creation and delivery.” They reduce the time and resources needed to schedule and present demos, ultimately shortening sales cycles and cutting costs. By weaving demos into GTM motions, teams can accelerate their sales velocity, reduce friction, and improve overall marketing effectiveness.

Interactive Demonstrations Drive Significant Benefits for Marketing, Sales and Presales

Source: Gartner (July 2024)

Why Reprise?

As you think about the right vendor for your demo program, it’s important to consider the method they use for live sales demos. Most demo providers are able to handle product tour use cases, but using that same technology for live sales demos can be risky.

Complicating matters further, not every product is able to be demoed using the same method. There’s no silver bullet. You might even need different methods within the same product! Maybe there’s a portion of your demo where you can use your live app — it just needs to have the right data. But then there’s another section of your product that needs to be reset after every demo, so a self-contained environment would be best.

There isn’t always a single best approach. That’s why demo software should be able to handle multiple methods for doing live sales demos, and buyers should beware of getting siloed into any one approach.

Here are some questions to help guide your evaluation:

- What kinds of product experience assets should we deliver – e.g. interactive tours, guided demos, leave-behinds, sandbox environments?

- Is it important that the version of the product we demo always be the most up to date?

- Do we want to show workflows in our demo (i.e. things changing)? How important is it then to reset the demo to a steady state?

- Who will be the primary users and stakeholders of our demo program? How do we want them to access, use, and engage with demo assets?

- What are the most important features and capabilities required of our demo platform – for instance, do we need to modify text, charts / graphics, and/or underlying data sets within the demo?

- How do we want users to interact with the product and how will we keep them engaged?

Reprise stands out as the go-to platform for enterprises that need to support multiple demo use cases from a single, fully-integrated demo platform. While other vendors offer point solutions for specific use cases, Reprise delivers a comprehensive solution for companies looking to scale demo programs across the entire buyer journey and for every method of doing live sales demos. Whether it’s through employee enablement, customer training, or sophisticated sales demos, Reprise empowers companies to build flexible, impactful demo programs that will grow with them.

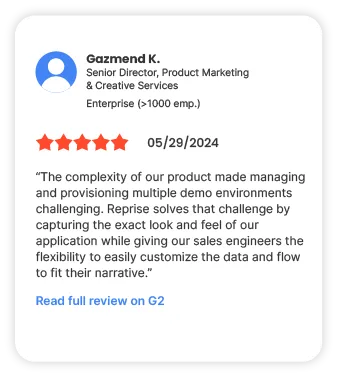

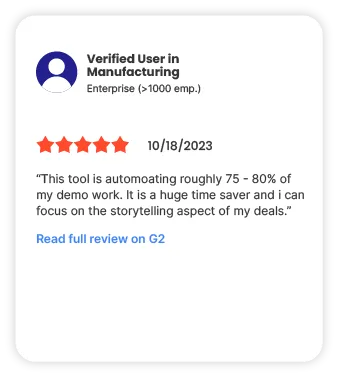

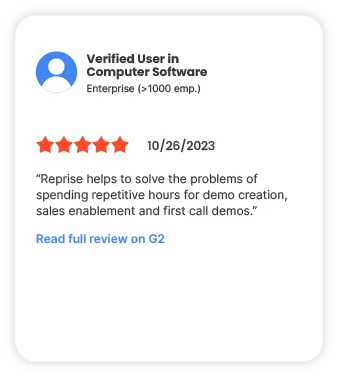

Reprise customers have spoken, and their feedback on G2 is a testament to the platform’s ability to serve diverse enterprise needs. As the demo software market continues to evolve, Reprise is helping enterprises take full advantage of this rapidly maturing space.

1 Gartner, Hype Cycle for Revenue and Sales Technology, 2024. Guy Wood, Adnan Zijadic, Melissa Hilbert, Ilona Hansen, Varun Agarwal. 17 June 2024.

2 Gartner, Market Guide for Interactive Demonstration Applications, 2024.

3 Gartner, PLG Tactics Fatten Sales Funnels for Tech CEOs of Complex Products. Ron Burns, Radu Miclaus, David Yockelson. 10 May 2024.